In a Standard Cost System Finished Goods Are Reported in

The balance sheet at actual cost. Direct materials direct labor variable overhead and fixed overhead.

Standard Costing Definition Advantages Disadvantages

The planned or standard cost value of the finished goods can be set up to be reported to ledger accounts.

. ACCT 281 CHAPTER 24 Question 1 A B C D A standard cost is the per unit cost incurred. View Notes - Practice Quiz Chapter 24 from ACC 281 at Texas State University. The standard cost is the average or anticipated cost of producing an item under normal circumstances.

The actual cost to produce a product may differ from the estimated standard costs. The Standard Cost Estimate is the process of calculating the standard cost of finished and semi-finished materials under SAP Controlling. The cost of finished goods includes all expense along the way and includes the three main components that go into the production of goods -- direct labor direct materials and overhead.

In a job order costing system all manufacturing costs ie direct materials direct labor and applied manufacturing overhead of the job are debited to work in process account. A standard cost system determines inventory unit cost based on some reasonable historical or expected cost. A quality order can be created for the reported quantity based on the setup of a quality association.

The income statement at standard cost. The total amount of finished goods inventory on hand as of the end of a reporting period is typically aggregated with the costs of raw materials and work-in-process and is reported within a single Inventory line item on. Standard costs are used to value raw materials inventory work-in-process inventory finished goods inventory and cost of goods sold.

What you need now is to create an item for the finished goods juice. Material costs incurred during the manufacturing process are generally 100 variable the units of material used is directly related to the number of items produced. These costs are frozen until a decision is made to change them.

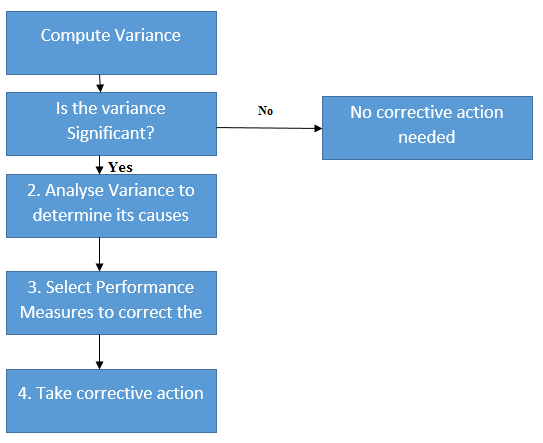

The balance sheet at standard cost. The standard costs set should be realistic and achievable based on accurate historical or. Variances are computed for each manufacturing cost.

Item model group for the item must be standard cost and production type must be Formula or BOM. In a system designed to measure cost variances goods transferred from the Work in Process account to the Finished Goods Inventory are valued at. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records.

Recording finished goods and cost of goods manufactured. Subsequently variances are recorded to show the difference between the expected and actual costs. Therefore a part purchased for 1 each at 1000 with a 500 import fee would result in a 15 per unit price due to landed cost.

Landed cost allows the extra cost of importing freight etc to be included over and above the purchase price of a part. When standard costing is used the manufacturers general ledger accounts for inventories materials work-in-process finished goods and the cost of goods sold will contain the standard costs. We also call it Material Cost Estimate in SAP too.

In a standard cost system finished goods are reported in. Setting Standard Costs. In addition when finished goods are maintained in inventory a.

Under standard costing the stock or inventory is valued at any predetermined or pre-established cost and any variances are expensed as manufacturing variances these costs are added up to the costs of products going for production and hence. Placing bids securing contracts and establishing sales prices are greatly enhanced by the availability of reliable standards and the continuous review of standard. Studies of past and estimated future cost data can then provide the basis for standard costs.

I used a formula item. In a standard costing system all inventory accounts reflect standard cost information. The use of standard costs stabilizes the influence of materials costs.

This approach represents a simplified alternative to cost layering systems such as the FIFO and LIFO methods where large amounts of historical cost. It is the repetitive nature of the production process which allows reliable and accurate standards to be established. If the standard quantity of materials is 84500 units at 015 per unit and the actual quantity is 95000 units at 012 per unit then the materials quantity variance is.

The cost of finished goods inventory is considered a short-term asset since the expectation is that these items will be sold in less than one year. Think of the standard costs as the should be costs which are tied to the amounts in the companys profit plan Any differences between the actual costs and the standard costs will. We can create a standard cost estimate or material cost estimate with Transaction CK11N Tcode or by following the navigation path.

In a standard cost system finished goods are reported in. Standard costing and variance analysis is usually found in manufacturing businesses which tend to have repetitive production processes. BUT if this same transaction were to happen for Standard the cost would still be at.

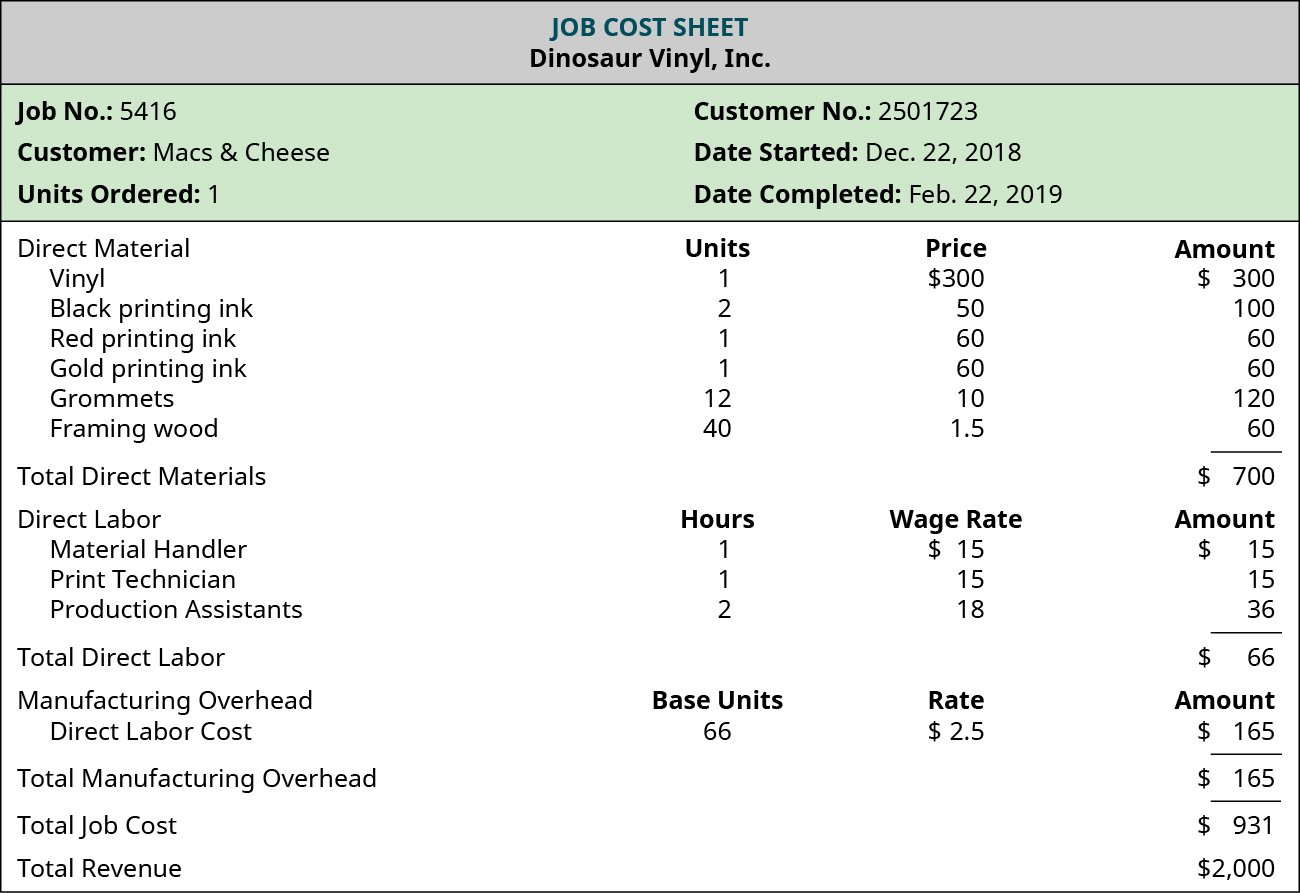

The Product information management Products Released products page the New button. EJB Company used a normal production level of 10000 units to determine. When a job is completed its cost as shown by job cost sheet is transferred from the work in process account to the finished goods.

In other words its what a business would normally spend to produce goods or services. The income statement at actual cost. A complete standard cost file by parts and operations simplifies assigning costs to materials work in process and finished goods inventories.

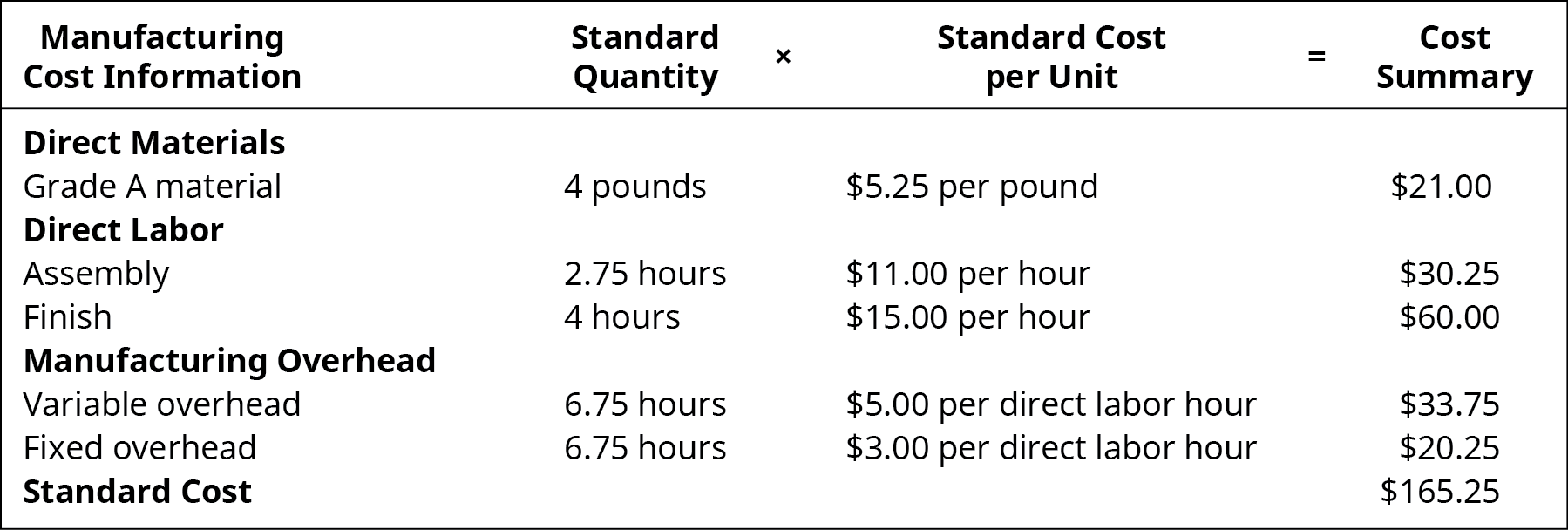

The balance sheet at standard cost. The difference between standard and actual data are recorded in the variance accounts and the manufacturing overhead account which are ultimately closed out. Assigning the cost of material to the standard unit cost of a finished good merely involves multiplying the units of the material used in the production by the standard cost per unit.

Standard Costing And Variance Analysis Standard Costing System

Chapter 9 Standard Costing And Basic Variances

Access Database Small Business Accounting Cashbook Templates Access Database Small Business Accounting Business Template

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Inventory Costing Bookkeeping Business Accounting Basics Inventory Accounting

Company Brochure Made For Hva Simple Business Cards Company Brochure Advertising Services

Income Statement Components Under Ias 1 Income Statement Financial Statement Analysis Financial Statement

Apa Itu Harga Pokok Penjualan Cost Of Goods Sold Cogs Harga Pokok Penjualan Keuangan Xxx

Costs Can Be Classified In Various Different Ways Depending On Its Nature And A Specific Purpose Such T Money Management Advice Cost Accounting Budgeting Money

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

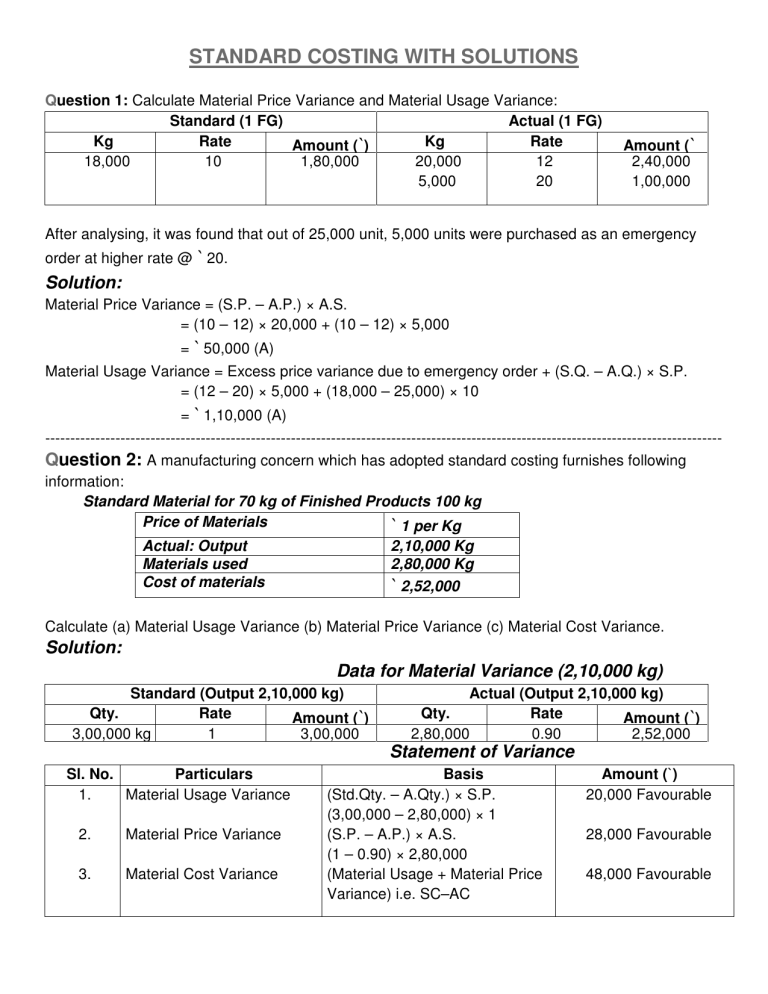

Standard Costing With Solutions

Explain How And Why A Standard Cost Is Developed Principles Of Accounting Volume 2 Managerial Accounting

Explain How And Why A Standard Cost Is Developed Principles Of Accounting Volume 2 Managerial Accounting

Comparison Of Job Costing With Process Costing Managerial Accounting Cost Accounting Accounting Education

Guangdong Tindle Storage Equipment Co Ltd Default Have Good Day Guangdong Storage

Pin By Cayenne Foster On Crafts Learn Accounting Accounting Education Accounting And Finance

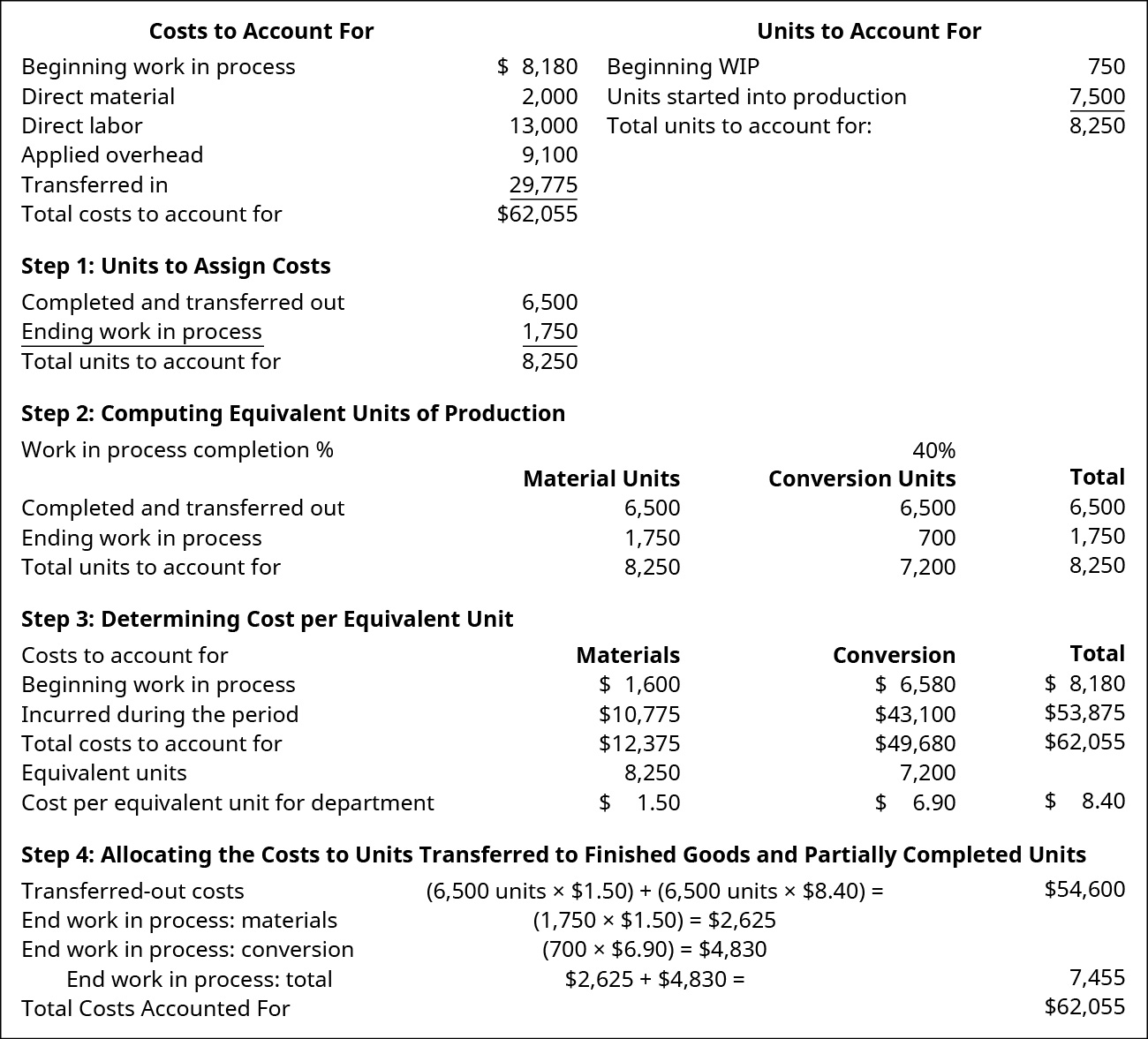

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting

The Camden Council Building In Oran Park Nsw Features Custom Slatted Ceiling Tiles By Supawood Products Finish Atrium Design Public Architecture Timber Slats

Comments

Post a Comment